Blocking the accounts

- 3975

- 208

- Jeffery Jones

This is an accounting riddle that anyone who has the slightest idea of the principles that govern profits and benefits will be resolved in a jiffy.

I explain it because it is based on a fact that actually occurred, where all the parties had different opinions and I had to make a referee. So it seemed an excellent material for a riddle.

It is said that in a very Pius town of New Hampshire hired an agent to be the only one authorized to sell liquor for a year. They gave him $ 12 in advance in cash, and liquors worth $ 59.50 at cost price. When he paid accounts at the end of the year, the agent declared extra purchases of liquor worth $ 283.50 and sold liquor worth $ 285.80, also receiving a 5% commission instead of a salary.

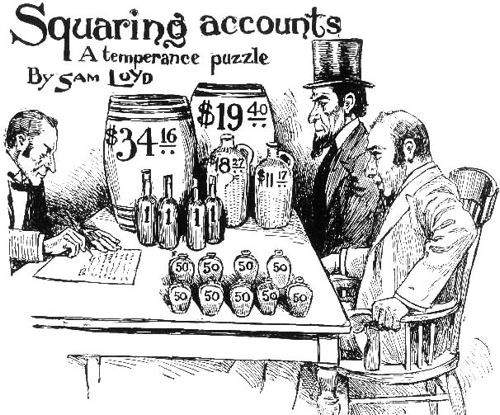

The illustration shows the agent with the people committee counting the stock, with each product marked with the sale price.

How much benefit did the town get for the sale of the liquor? This includes determining the agent commission.

SolutionThe agent started with 12 $ in cash and $ 59.50 in liquor. Buying $ 283.50 in liquor increased its stock up to $ 343 (cost price). On this price it applied 10% giving it a sale price of $ 377.30. Sold $ 285.80, and stayed with $ 91.50 without selling, as you can see in the Enlightenment. These $ 91.50 would have a cost price of $ 83.18.

If we subtract this sum of $ 343 (the cost value of the entire stock), we will have $ 259.82 corresponding to the cost of the liquor that sold.

If we subtract this value of the value of sales ($ 285.80) we will have to The benefit obtained by the town for liquor sales was $ 25.98.

$ 25.98 more than $ 12 advanced at the beginning plus $ 59.50 of liquor = $ 98.48.

If we subtract the commission of the agent of $ 14.29, we have $ 83.19, which is the cost value of the liquor that remains.

That is, the agent was only wrong for two cents.